The Colorado real-estate license is a state-issued document indicating that a person meets the requirements for licensing as a real agent. Although the process of obtaining a license can seem daunting, with the right information and resources you can navigate it.

Pre-Licensing Classes and Test Prep

Pre-licensing courses must be completed by a state-approved educational provider in order to obtain a Colorado real estate license. These courses can also be taken online, in-person or via Zoom. Some schools offer an array of learning options such as small group classes, accelerated one to one training, and even small group classes.

Exams are an important part of licensing. It's crucial to plan ahead by reviewing your prelicensing materials, and investing in exam preparation tools. These include flashcards as well as study schedules, flashcards, exam prep books, and simulated exams.

How to become Colorado's Real Estate Agent

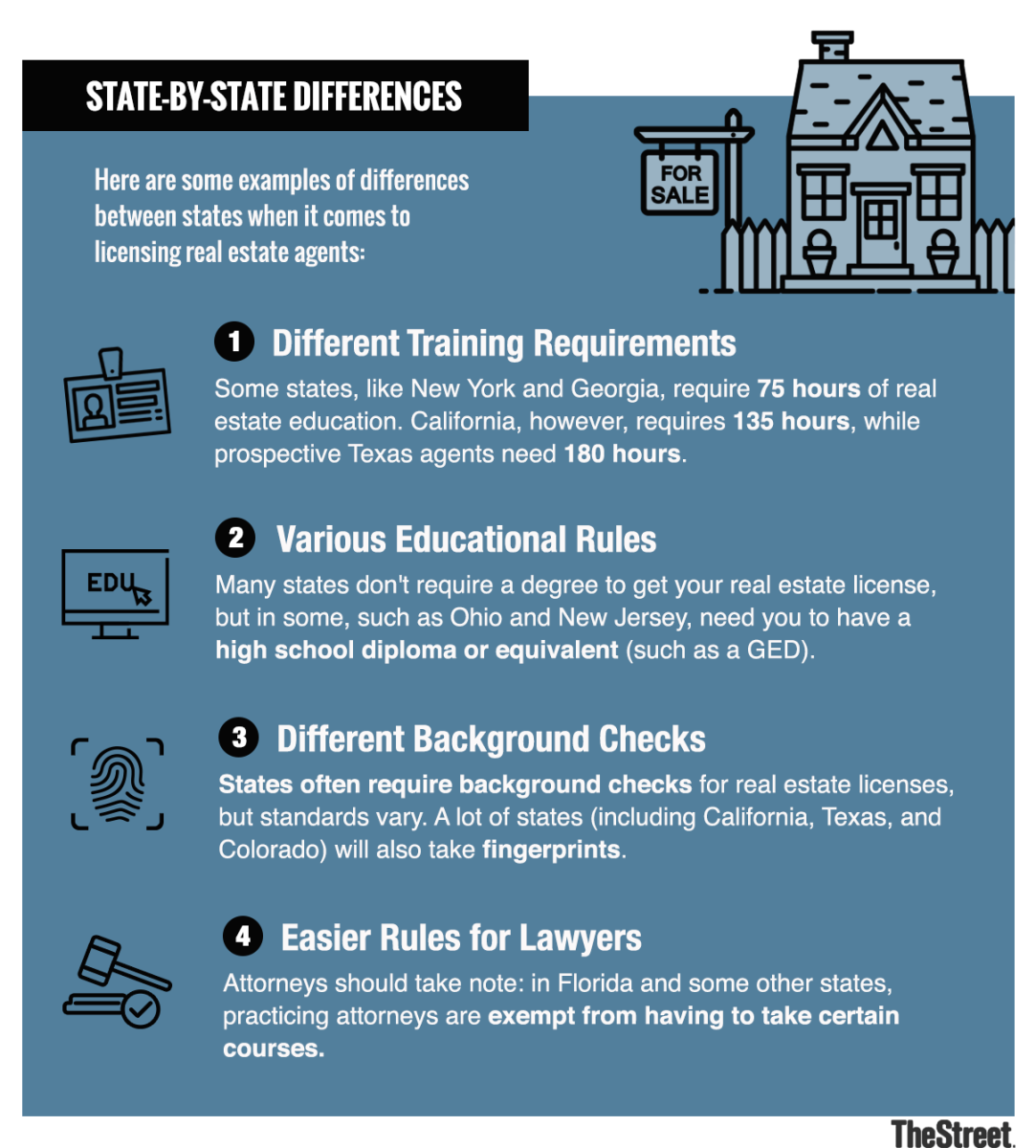

Colorado requires that you are 18 years old and have a high school diploma, GED certificate or equivalent. You also need to pass the background check to begin working as a Colorado realty agent. Once you pass this step you can proceed to the next stage: joining a broker and getting your license.

Colorado Brokering

To be licensed in this state as a broker, you will need to have completed 168 hours education, passed the broker exam, and be fingerprinted. A broker's license is also possible if you have worked as a salesperson, or in a related field.

You can choose to take your prelicense education online, livestream, and in-person. Some schools even offer accelerated, one-on-1 training to help students pass the real estate exam their first time.

The Colorado broker exam is a two-part exam that is proctored by a third party. The exam is multi-choice and lasts for approximately two hours. It covers both federal and state law. You must pass both parts to receive your broker's license.

Colorado may allow you to reciprocally license a broker licensed in another state if you've been licensed in that state for at most two years. This type of licensing can save you time and money, since it eliminates the requirement for a full 168-hour real estate education course.

How to Become a Broker in Colorado

Before you can apply to get your license, you will need your fingerprints taken and paid for a background check by the state of Colorado. You can choose from a variety of approved vendors to help you with these steps.

Choosing a Real Estate License Prep Program

After you've completed the pre-license education, it's time to start preparing for the real estate licensure exam. The Colorado test is notorious for being one of the most difficult in the country, so it's important to have the proper strategies and tools in place. Kaplan's Colorado exam preparation packages are highly recommended. These include practice questions and simulated tests.

FAQ

How do I calculate my rate of interest?

Interest rates change daily based on market conditions. The average interest rate during the last week was 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

Do I need to rent or buy a condo?

Renting might be an option if your condo is only for a brief period. Renting will allow you to avoid the monthly maintenance fees and other charges. However, purchasing a condo grants you ownership rights to the unit. The space is yours to use as you please.

How long does it take for my house to be sold?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It can take anywhere from 7 to 90 days, depending on the factors.

Is it possible fast to sell your house?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. There are some things to remember before you do this. First, you will need to find a buyer. Second, you will need to negotiate a deal. Second, prepare your property for sale. Third, it is important to market your property. You should also be open to accepting offers.

Should I use a mortgage broker?

A mortgage broker may be able to help you get a lower rate. Brokers work with multiple lenders and negotiate deals on your behalf. However, some brokers take a commission from the lenders. Before signing up, you should verify all fees associated with the broker.

What are the key factors to consider when you invest in real estate?

The first step is to make sure you have enough money to buy real estate. You can borrow money from a bank or financial institution if you don't have enough money. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

It is also important to know how much money you can afford each month for an investment property. This amount should include mortgage payments, taxes, insurance and maintenance costs.

It is important to ensure safety in the area you are looking at purchasing an investment property. You would be better off if you moved to another area while looking at properties.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to Find an Apartment

When you move to a city, finding an apartment is the first thing that you should do. This process requires research and planning. It involves research and planning, as well as researching neighborhoods and reading reviews. While there are many options, some methods are easier than others. The following steps should be considered before renting an apartment.

-

Data can be collected offline or online for research into neighborhoods. Websites such as Yelp. Zillow. Trulia.com and Realtor.com are some examples of online resources. Local newspapers, landlords or friends of neighbors are some other offline sources.

-

Read reviews of the area you want to live in. Yelp, TripAdvisor and Amazon provide detailed reviews of houses and apartments. You can also find local newspapers and visit your local library.

-

For more information, make phone calls and speak with people who have lived in the area. Ask them what the best and worst things about the area. Ask for their recommendations for places to live.

-

Take into account the rent prices in areas you are interested in. If you think you'll spend most of your money on food, consider renting somewhere cheaper. Consider moving to a higher-end location if you expect to spend a lot money on entertainment.

-

Find out about the apartment complex you'd like to move in. Is it large? How much does it cost? Is it pet friendly What amenities does it have? Is it possible to park close by? Are there any rules for tenants?