Buyers should be aware of how realty agents are paid when they consider a realty transaction. The commission split is between the agent and brokerage. However, they generally earn less from higher-priced properties than the seller’s agent's fee. Buyer's Agents can earn up 3% more depending upon the company. A buyer's agent must work hard to get every client. The national average salary is not accurate as it doesn't account for the work that an agent does.

Commission split between agent/broker

Although they are not uncommon, traditional commission splits can become costly for agents. A graduated split is similar as a traditional commission split, but the agent gets a larger slice of the pie for reaching milestones. An example is that an agent who earns $60,000 per year in gross commissions shifts to an 80/20 split. After a million dollars, they shift to an 80/20 split. In the meantime, the broker keeps paying his agents a fixed percentage, which makes it easier for both parties to manage.

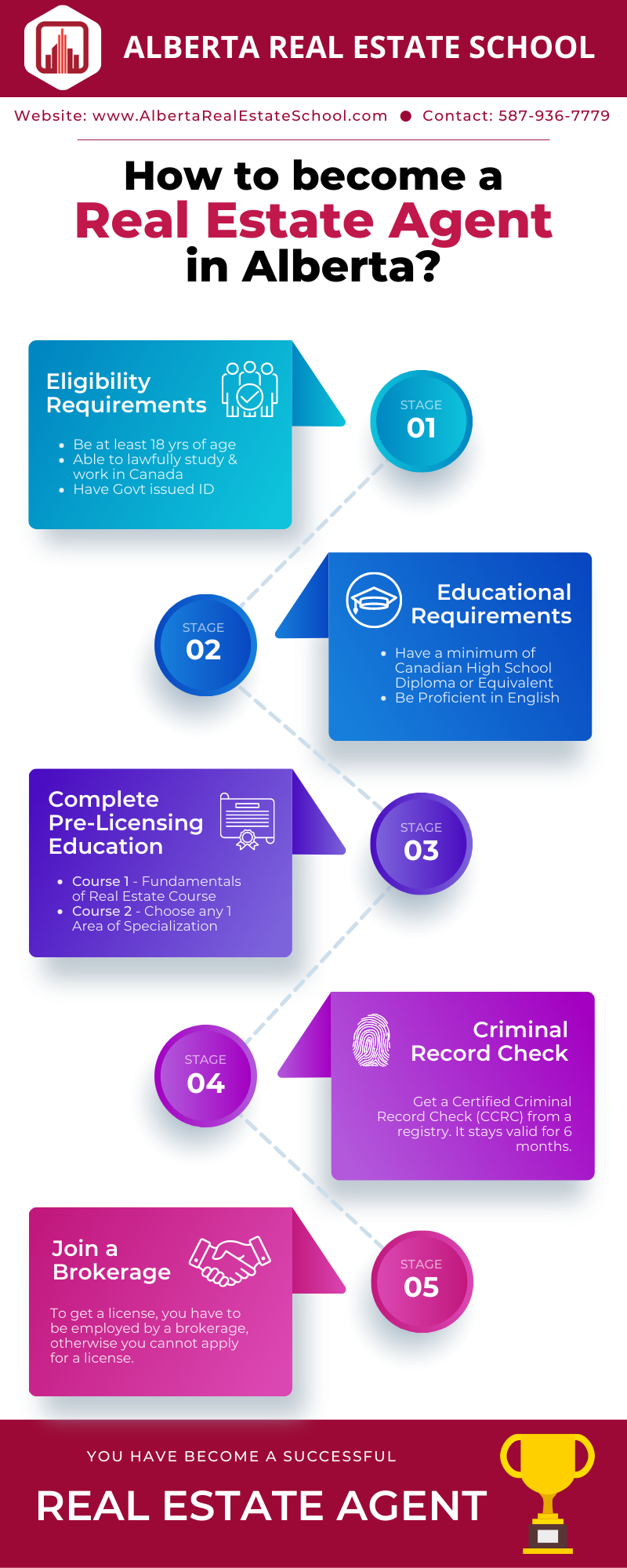

Although commission splits can vary depending on market and region, the general rule is that agents start with a 50/50 split which includes brokerage services and marketing. As agents grow their businesses and make more commissions, brokers increase the amount of commission that they pay to them. This was a practice that originated at the Remax franchise. The office fee paid by Remax agents covered rent and equipment. Agents were also required to pay for marketing expenses.

Compensation for higher-priced properties

There is a wide range in the compensation that real estate agents receive for selling high-priced homes. The compensation for agents who sell more expensive properties could reach into the millions. An agent selling 11 properties worth $5million will make $1.65 million in commissions. The more properties that they sell, they earn more. Although the commission percentage can vary, it has been around 6% in the past. Real estate can be a complicated field with many parties and terms.

Commission split between broker/company

Oft-contentious topics include the question of how a brokerage and a real agent split their commission. This topic is often covered up in the name of confidentiality. There are many ways to split commissions between real agents and brokerages. While most brokers split their commissions equally, others offer a graduated split. The splits increase as an agent's production increases, so higher producers are rewarded with a higher percentage of the commission split. Agents who do not make enough may not have enough income to cover their costs and keep their brokerage.

Be sure to take into account the peak selling season when you negotiate a commission split. High-volume sales are a great time for real estate agents to earn a higher commission percentage. Remember to account for franchise fees when calculating the commission split. You should also consider marketing time and effort required to market the real estate listings. Maximizing your profits in the realty business will be possible by understanding the commission splits.

FAQ

How do I repair my roof

Roofs can leak because of wear and tear, poor maintenance, or weather problems. Minor repairs and replacements can be done by roofing contractors. Get in touch with us to learn more.

Is it better buy or rent?

Renting is usually cheaper than buying a house. It's important to remember that you will need to cover additional costs such as utilities, repairs, maintenance, and insurance. Buying a home has its advantages too. For example, you have more control over how your life is run.

Do I need flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance protects your belongings and helps you to pay your mortgage. Learn more about flood coverage here.

How do I calculate my rate of interest?

Market conditions can affect how interest rates change each day. The average interest rate during the last week was 4.39%. Multiply the length of the loan by the interest rate to calculate the interest rate. For example: If you finance $200,000 over 20 year at 5% per annum, your interest rates are 0.05 x 20% 1% which equals ten base points.

Can I get another mortgage?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

What should I do before I purchase a house in my area?

It all depends on how many years you plan to remain there. If you want to stay for at least five years, you must start saving now. You don't have too much to worry about if you plan on moving in the next two years.

Should I rent or own a condo?

If you plan to stay in your condo for only a short period of time, renting might be a good option. Renting can help you avoid monthly maintenance fees. You can also buy a condo to own the unit. The space can be used as you wish.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to Find Houses To Rent

Finding houses to rent is one of the most common tasks for people who want to move into new places. However, finding the right house may take some time. Many factors affect your decision-making process when choosing a home. These include location, size, number of rooms, amenities, price range, etc.

You can get the best deal by looking early for properties. You should also consider asking friends, family members, landlords, real estate agents, and property managers for recommendations. You'll be able to select from many options.